The fourth principle of systems science states that all systems are dynamic over multiple scales of space and time.

A system is dynamic if it has at least one property that changes over time. “Dynamics” describe how systems behave as they change.

The changes that unfold within a system occur on multiple scales of time, such as seconds, days, and centuries. The changes that occur within a system can also be measured across space, either inches, miles, or light years. Humans mark our age through years and measure our lives by days and weeks. As we grow we track our height in feet and centimeters, while measuring the distances we travel in miles. The relevant level of analysis depends upon what we want to know.

Understanding systems dynamics is useful because it helps us predict how a given system may behave in the future and gives us clues as to what types of behavior can be expected in ones that are similar. This article will explore systems dynamics through the lens of the American economy, describing the four key components of direction, size, quality, and adaptivity.1

Direction

Direction is the simplest form of dynamics. Forces of physics cause movement across space, like a pool cue striking a billiards ball and sending it flying across the table. Flows occur between components within a system, like water going from a tank, through a series of pipes, and into the bathtub. The directions and motions may change over time, but the fundamental character and function of the system stays the same. Pool balls glide across the table, sink into pockets, and are reset in a new game, the tub is continually drained and refilled.

Within the U.S. economy, goods and services flow between states, people move in and out of industries, and capital goes from investors into stocks, bonds, and real estate.

When different directions collide, we get interactions. Interactions are the outcome of a unique arithmetic between two competing forces, creating emergent outcomes that may not be obvious from the outset. A pool ball bouncing off a wall and flying in a new direction is an example of an interaction, or a clogged pipe causing sewage to back up and overflow elsewhere.

The interaction between supply and demand for goods and services lies at the heart of market-based economic systems. Prices fluctuate in response to changes in supply and demand as buyers and sellers transact in the market, conveying useful information about scarcity and value. Where there is a low supply of housing in an area and lots of demand from buyers who want to live there, prices rise, reflecting the scarcity in the market.

In March, we saw how interactions between users on Twitter and a fragile banking system led to the world's first social-media driven “bank run” and the largest bank failure since the 2008 financial crisis. When fear about Silicon Valley Bank’s (SVB) health started spreading, customers rushed to withdraw their money. Because banks in our fractional reserve banking system only hold a fraction of the cash deposited by their customers, SVB had to scramble to find money in order to satisfy customer demands. They tried to raise this money by selling assets which led to more fear, more withdrawals, and a downward spiral. Eventually the government stepped in to prevent the bank from collapsing. Interactions can help optimize systems by spreading important information, but they can also contribute to feedback loops in which negative outcomes are compounded rather than alleviated.

Size

Understanding a changing system as a dynamic process requires measuring increases and decreases in size over time. Systems either grow, shrink, or stay the same.

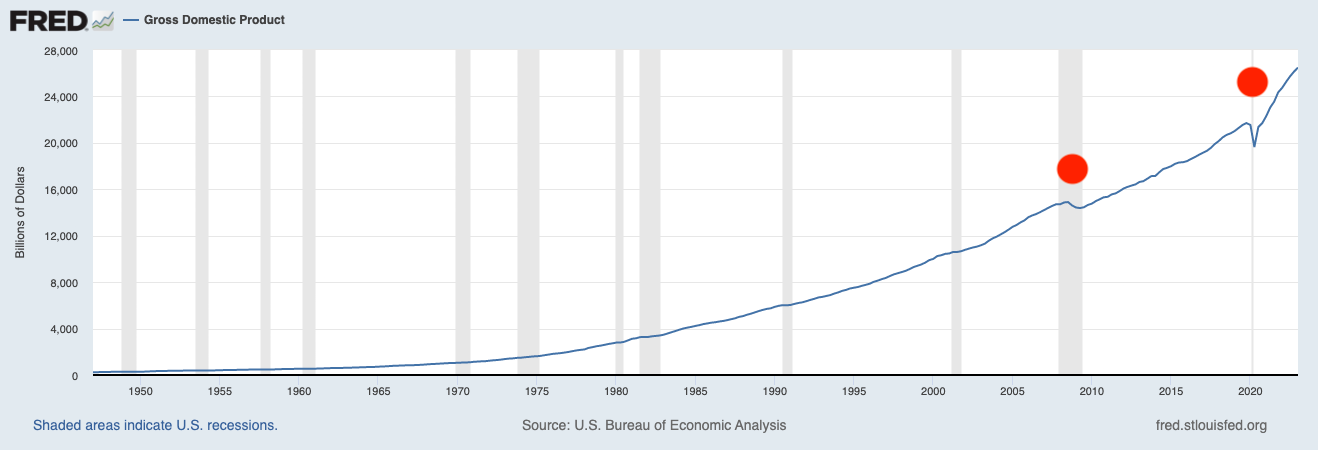

The standard measure of economic growth used by policy makers and mainstream economists is Gross Domestic Product (GDP). GDP measures the value of goods purchased by users within a nation’s economy.

Fluctuations in GDP are used to assess how the economy is changing. We say that the economy is booming when GDP is growing, and when it starts to shrink for a prolonged period we enter a recession. The dips in the chart below show the recessions that the U.S. economy experienced during the great financial crisis of 2008 and in 2020 during the Covid pandemic.

The size of an economy can influence its capacity to generate value, its efficiency, and its ability to absorb shocks. Economic superpowers like the United States and China have significant capacity to provide for their citizens and exert their will on smaller powers. Countries with smaller economies, like Taiwan or France, may benefit from being more dynamic, agile, and able to adapt to change, but they are less self-sufficient and often at the mercy of larger countries.

Quality

Quality can be understood as a measure of the overall development or decline of a system. As a system matures it will change and evolve in complexity, either growing more nuanced subsystems and enriching connections, or deteriorating and disintegrating into something barely viable. A developed system increases in complexity to increase efficiency and accomplish goals, whereas a system in decline grows simple, and weak.

In the post-WW2 period when the U.S. emerged as an economic powerhouse, there was a surplus of political and economic capital that could be directed towards developing complex infrastructure, such as the Interstate Highway System. Infrastructure for transportation and communication such as roads, airports, and power lines, greatly enhanced our interconnectivity and soon became a widely accepted and valued norm. These tools serve as a backbone for economic systems by enabling movement and flows of both people and information.

Today, there is widespread agreement across party lines that American infrastructure is in decline. Our roads are worn, water mains are breaking, and our systems for transmitting and distributing energy are not meeting the needs of the population. Commentators poke fun at the fact that China builds a train station within 9 hours while California can’t build a bus shelter with the help of 8 departments, and the city of San Francisco takes 20 years to fix a public restroom.

Well developed, high quality systems have a greater chance of enduring far into the future. Large systems with low quality components simply cannot sustain themselves. Declining quality of American infrastructure will lead to higher costs, decreased productivity, supply chain disruptions, and inhibited innovation. This could threaten the country's status as world superpower and lead to a lower overall quality of life for its citizens.

Adaptivity

A system adapts by modifying its behavior in response to environmental changes. Adaptivity can be understood along different scales of time. Human brains are highly adaptive in terms of what we are capable of, which is why we can live in so many diverse circumstances, but the evolution of our species and instincts evolved over the course of millenia. A tree can alter the way it grows to seek sunlight, but it can’t change the shape of its leaves except across multiple generations of variation, selection, and retention.

When Covid-19 was spreading throughout the nation and there were mask shortages, student groups across the nation adapted by producing 3D printed masks. The federal government adapted by using its power to print money, creating several trillion new dollars and injecting them into the economy in an effort to stimulate demand.

With the release of ChatGPT and the rise of LLMs, organizations are adapting to the arrival of AI. Google combined its DeepMind and Brain AI research groups into a single unit. Apple has restricted the use of chat GPT among employees over concerns that confidential information entered into these systems will be leaked or collected, and IBM has paused hiring for 7,800 positions that it believes AI could replace.

These various adaptive changes will significantly alter the structure and functioning of the U.S. economy over time.

Printing money can lead to inflation, resulting in higher prices for basic goods and services.

3D printing is disrupting manufacturing and supply chains by enabling decentralized and on-demand production. This will reduce high costs associated with long-distance shipping and product prototyping.

AI is automating many tasks that humans have performed such as marketing, advertising, customer service, and data entry. As jobs are automated out of existence, this could contribute to higher unemployment rates if people aren’t able to develop new skills and find new positions.

The economic fabric of our society will need to radically readjust to a new normal where many historic jobs are now performed by computers.

The Economy as a Complex Adaptive System

Mainstream economics relies on theories and models that fail to account for the dynamic nature of the economy. As a result, most economists can’t make useful predictions or provide sound policy advice.

The failures of economists are especially apparent when looking at how society has come to “fetishize” GDP. For Simon Kuznets, the economist who pioneered usage of the metric in 1937, GDP was one useful measure that helped track the amount of goods in the US economy. He warned and clearly stated that GDP should not be used to measure economic well-being.

Kuznets’ warning was not heeded. Today we rely on GDP as the primary measure of economic growth and development. It is the gauge we look at to tell us how healthy the economy is. The equation tells us that when there is more demand for goods and services this leads to a need for more production. The need for more production leads to jobs being created and thus more employment. Therefore, injecting money into the economy to stimulate demand = higher employment. It's simple, basic math!

This sort of misguided thinking has led us astray as economic theorists have desperately tried to imitate the methods of the physical sciences. They attempt to represent the functioning of the entire economy with mathematical equations containing a few key variables that can be tweaked in order to steer us towards “equilibrium.”

In reality, the economy is a complex system whose behavior is dependent on an immeasurable number of influential variables. Different methods, and humbler expectations are required.

A better approach to economic theory would spend less time attempting to provide precise forecasts and methods for controlling the economy. Instead, it would focus on predicting general types of patterns we can expect and the conditions that tend to lead to those patterns emerging. Economists should use their knowledge, “not to shape the results as the craftsman shapes his handiwork, but rather to cultivate a growth by providing the appropriate environment, in the manner in which the gardener does this for his plants.”

Systems science can play a key role in facilitating the development of more useful economic theories that would allow us to embrace a cultivation mindset rather than that of a craftsman. Systems inquiry sacrifices predictability in order to provide us with better, more relevant questions, and preventative measures. There is an abundance of promising research focused on treating the economy as a complex adaptive system (ie: Complexity economics, Macroeconomics as Systems Theory, Network Analysis of the US–China Hegemonic Transition.) Society must direct more resources, intellectual and financial, towards supporting this type of work.

Next week we’ll be covering complexity, one of the most important concepts in systems science. Most of the systems that we are interested in building, understanding, and improving (like the economy) contain considerable amounts of complexity.

Here are a few prompts for reflection and discussion:

Think of a system you are familiar with and consider how direction, size, quality, and adaptivity operate within it. For instance car traffic, your workplace, or the city you live in.

How might these dynamics change over time and for what reasons?

Consider how the system dynamics manifest on different levels of spatial or temporal analysis. How does zooming out or in on a given phenomena change your perception of it?

In the textbook Principles of Systems Science these are described as “Motion and Interaction, Growth and Shrinkage, Development and Decline, and Adaptivity.” I’ve altered them slightly for the sake of simplicity.