The Power of Prediction Market Systems

Substack just added support for “prediction market embeds” to the platform.1

Now, writers can include market-based predictions for a wide variety of important events directly in their posts.

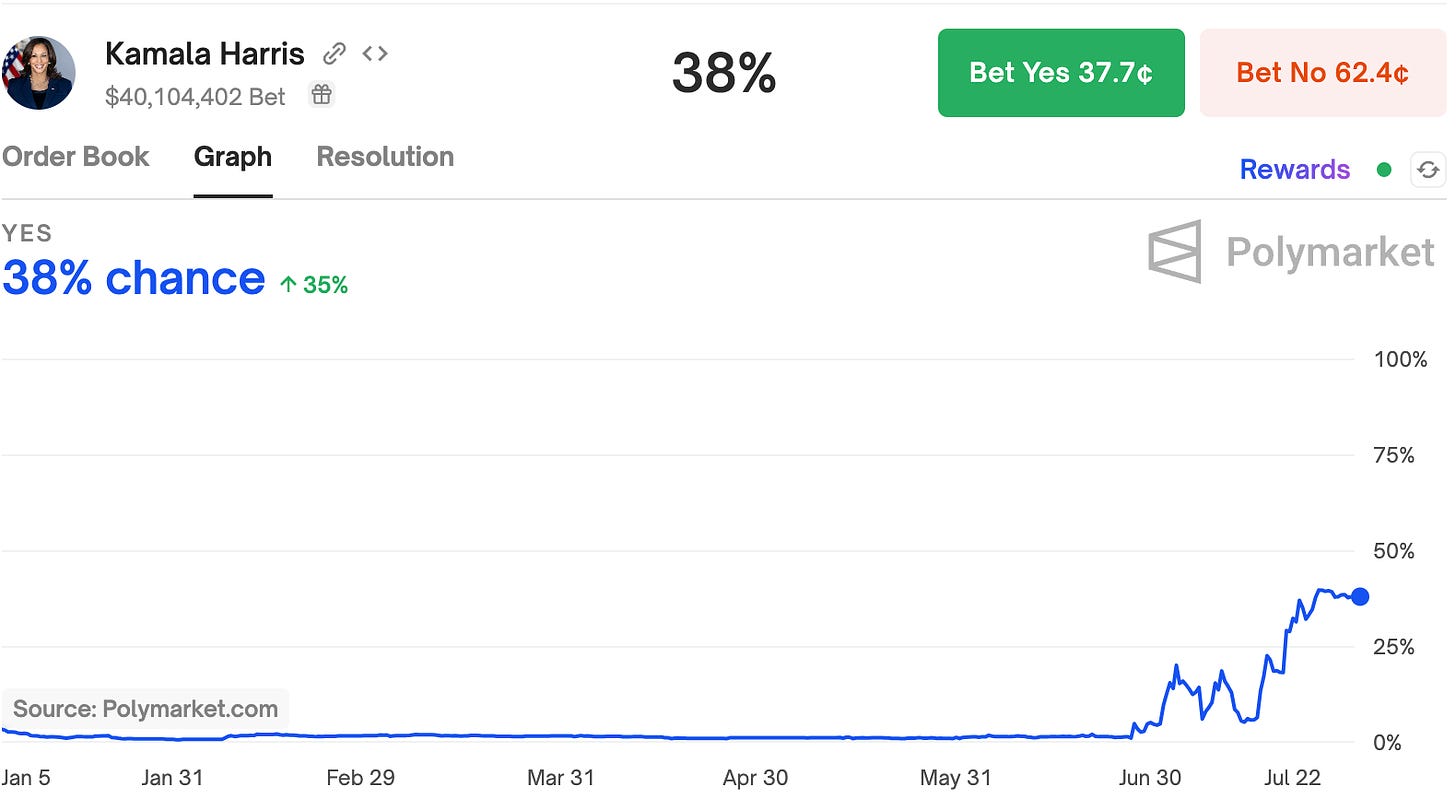

Like this.

Many users are scratching their heads and blasting this as a bone-headed move. Since Substack didn’t do a great job of explaining why prediction markets are so potentially useful, this is understandable.

The reality is that prediction markets are poised to completely transform the way society relates to sense-making and forecasting. Their potential capacity to aggregate opinions from large and diverse populations and turn this information into accurate forecasts is far greater than that of any existing polling techniques.

So, this week I’d like to talk a bit about what prediction markets are, how they can be useful, and what sort of systemic impact their adoption may have on society.

What are Prediction Markets?

Prediction markets are systems that let people bet on the outcome of uncertain future events.

With traditional polling systems, respondents have no “skin in the game.” If I check “yes” on a box in a poll for the question above, there are zero consequences and I have no incentive to rethink my answer. Even if I do change my mind, I can’t “retake” the poll.

In contrast, prediction markets are like continuous, never-ending polls where all of the participants have money on the line and the results are updated in real time.

Instead of buying $100 of Tesla stock, I might decide to buy $100 of “Yes Kamala will win” shares and be rewarded handsomely if she defies expectations. I can adjust my bet anytime as I gather new information about reality. The fact that my forecast has direct consequences for my financial well-being incentivizes me to constantly update my opinion.

The market price of an event outcome will always represent the consensus about what the group expects is most likely to happen.

38 cents for a yes share = 38% current expected probability of the outcome occurring.

For more details on the underlying mechanics behind prediction markets and my personal perspective of how they might benefit society, you can read these two pieces that I wrote back in 20162 and 2019.3

But at their core, they are systems which take individual bets on future outcomes as inputs, and produce collective probability estimates of occurrences as outputs.

How Can They Be Useful?

Why in the world would we want everyone betting on the likelihood that anything might happen?

It’s a good question, and I understand why nearly all of the critics in the Substack announcement post comments completely miss the point.

For the skeptics, here are a few areas where research has demonstrated clear potential for prediction markets to benefit society.

We can have a much more productive and nuanced conversation once we establish the fact that prediction markets weren’t created simply to satisfy the vices of degenerate gamblers.

General Forecasting

In 2008, a group of economists including Nobel Laureates Kenneth Arrow, Thomas Schelling, and Robert Schiller authored a paper on The Promise of Prediction Markets.4 The piece provides a succinct review of the extensive and compelling evidence that prediction markets “can help to produce forecasts of event outcomes with a lower prediction error than conventional forecasting methods.”

Science

Several studies have shown that prediction markets can serve as a useful mechanism to help incentivize funding for basic scientific research. They’ve also shown potential to help improve the reproducibility of studies in fields, like psychology, that are facing a reproducibility crisis.5 6 7 8

Intelligence

A 2006 CIA report detailed how “prediction markets can substantially contribute to US Intelligence Community strategic and tactical intelligence work.”

The analyst, after reviewing the effectiveness of prediction markets in a wide variety of scenarios from pharmaceutical drug development to geopolitical forecasting, concludes that:

“The record of prediction markets is impressive. For the US Intelligence Community, prediction markets offer a method by which to improve analytical outcomes and to address some of the deficiencies in analytical processes and organization.” 9

What Systemic Impact Might They Have?

In the short term, I think prediction markets will play an important role in disrupting some of the distorted incentive structures in legacy institutions.

We want to incentivize more people to constantly evaluate and think critically about what is likely to happen, rather than confidently asserting their opinions based on what corporate media has told them.

Thanks in large part to Polymarket (the platform behind Substack’s new feature), I wasn’t surprised at all by Biden dropping out or Kamala becoming the new Democratic nominee. I was expecting both as very likely outcomes while media pundits were insisting Biden wasn’t going anywhere.

The market saw it coming long before the “experts” did.

In the long term, I can imagine how these types of markets might create negative externalities if broader social and political issues remain unaddressed. I’d love to have accurate, real-time, crowd sourced predictions about the likelihood of a global pandemic being declared. But, I’m also concerned about markets being used to incentivize outcomes I’d consider harmful.

Whatever happens, if Polymarket maintains its current trajectory of bringing prediction markets to the mainstream, we are likely to enter an era where society gathers much more granular information about what everyone believes is likely to happen.10

We should observe these systems carefully to learn more about how they work when they work, and why they sometimes may not work so well. The sooner we start experimenting with and studying them at scale, the better.

Substack, O. (2024, July 29). Introducing prediction market embeds for Substack [Substack newsletter]. On Substack. https://on.substack.com/p/dynamic-prediction-market-tables

Thornton, S. (2016, January 12). Practical Applications of Cryptocurrency: Decentralized Prediction Markets. Medium. https://medium.com/@shingaithornton/practical-applications-of-cryptocurrency-decentralized-prediction-markets-95a15be69a76

Thornton, S. (2019, March 27). Practical Applications of Decentralized Prediction Markets. HackerNoon.Com. https://medium.com/hackernoon/practical-applications-of-decentralized-prediction-markets-cac0bcbd117

Arrow, K. J., Forsythe, R., Gorham, M., Hahn, R., Hanson, R., Ledyard, J. O., Levmore, S., Litan, R., Milgrom, P., Nelson, F. D., Neumann, G. R., Ottaviani, M., Schelling, T. C., Shiller, R. J., Smith, V. L., Snowberg, E., Sunstein, C. R., Tetlock, P. C., Tetlock, P. E., … Zitzewitz, E. (2008). The Promise of Prediction Markets. Science, 320(5878), 877–878. https://doi.org/10.1126/science.1157679

Almenberg, J., Kittlitz, K., & Pfeiffer, T. (2009). An Experiment on Prediction Markets in Science. PLOS ONE, 4(12), e8500. https://doi.org/10.1371/journal.pone.0008500

A Market for Basic Science? (2017, February 6). American Scientist. https://www.americanscientist.org/article/a-market-for-basic-science

Dreber, A., Pfeiffer, T., Almenberg, J., Isaksson, S., Wilson, B., Chen, Y., Nosek, B. A., & Johannesson, M. (2015). Using prediction markets to estimate the reproducibility of scientific research. Proceedings of the National Academy of Sciences, 112(50), 15343–15347. https://doi.org/10.1073/pnas.1516179112

Mann, A. (2016). The power of prediction markets. Nature, 538(7625), 308–310. https://doi.org/10.1038/538308a

Yeh, P. F. (2006). Using Prediction Markets to Enhance US Intelligence Capabilities: (741212011-004) [Dataset]. https://www.cia.gov/resources/csi/static/Prediction-Markets-Enhance-Intel.pdf

Polymarket. (n.d.). Welcome to The Oracle by Polymarket. Retrieved July 31, 2024, from https://news.polymarket.com/p/welcome-to-the-oracle-by-polymarket